If you’re an international student coming to study in Germany, you’ll have to prove that you have the funds to cover your living costs for the whole time you intend to study in the country. The main way that students are able to prove this is by opening what’s called a blocked bank account.

Opening a blocked account in Germany is an essential part of your international German student visa application, it’s something that every student will be asked for.

This guide will take you through everything you need to know about opening up a blocked bank account, including who the best-blocked bank account provider is. After reading this, you’ll easily be able to start the application to open your own blocked account.

What are the required documents to open a blocked account in Germany?

The best-blocked accounts for international students in Germany

When is the best time to open your blocked account in Germany?

Do I need to prove the source of the money when transferring money?

Can I keep using the blocked account after I finish my studies in Germany?

A blocked account is a special type of German bank account for internationals coming to study, or work, in Germany.

It’s called a ‘blocked account’ because the money that you deposit into it cannot be withdrawn until you arrive in Germany. Once you arrive you can then set up a monthly transfer of the funds to your current bank account.

The money that you deposit into the account works as a guarantee to the German government. It shows that you’ll be able to provide for yourself during your studies without having to rely on help from the government.

International students need to open up a blocked account as part of their visa, or residence permit application as it proves that they have the financial resources to support themselves. It’s an account that you deposit a large sum of money to that will help you with your day-to-day living expenses while studying in Germany.

This is an essential part of the visa application that all internationals will be asked to do. Although there are some other ways that you could prove your finances, opening a blocked bank account is the most common way to do it.

Yes, if you are planning to attend a Studienkolleg, you’ll be asked to submit funds to a blocked account as part of your student visa application.

Check out our Studienkolleg preparatory course (Prep4University)

Although a blocked account is the most common method that international students use to prove that they have sufficient funds for the duration of their stay in Germany, there are alternative ways that you can prove this.

Here’s a list of some of the other documents you could include in your visa or residence permit application to prove that you have enough funds to pay for your stay in Germany:

A guarantee from your bank

A letter of commitment from a relative or friend where they agree to cover your expenses

A scholarship certificate from a recognised scholarship provider

A document showing your parent’s income and financial status

Opening up a blocked bank account in Germany as an international student is actually really simple - most of it can be done online and shouldn’t take more than a few minutes.

Choose your provider. Keep reading to find out more about the different banks that offer blocked accounts for international students in Germany.

Visit the bank’s website and find the option to apply. This should be easy to find on the bank’s website.

Download and fill out an application form, if required. Not all of the banks will ask you to do this.

Deposit your funds. The current amount from 1st of January 2021 that must be deposited to a blocked account is €10,332, or €861 per month but you should always check before transferring any money.

Receive your blocking confirmation. This will be sent out by the bank to prove that you have set up a blocked account. You can use this document in your visa application.

Check out our undergraduate degrees

Check out our graduate degrees

Depending on what country you’re from, you may be asked to supply different documents to have your blocked account application approved.

With some of the banks that provide blocked accounts for international students, you’ll only be asked to upload an image of your ID or passport, but with some banks, you may be asked to provide more than that.

Here are some of the documents that you may be asked for when applying for a blocked account in Germany:

A filled-in application form will be provided by the bank

An image of your valid passport or ID card

The admission letter from the university you’ll be studying at

A recent bank statement

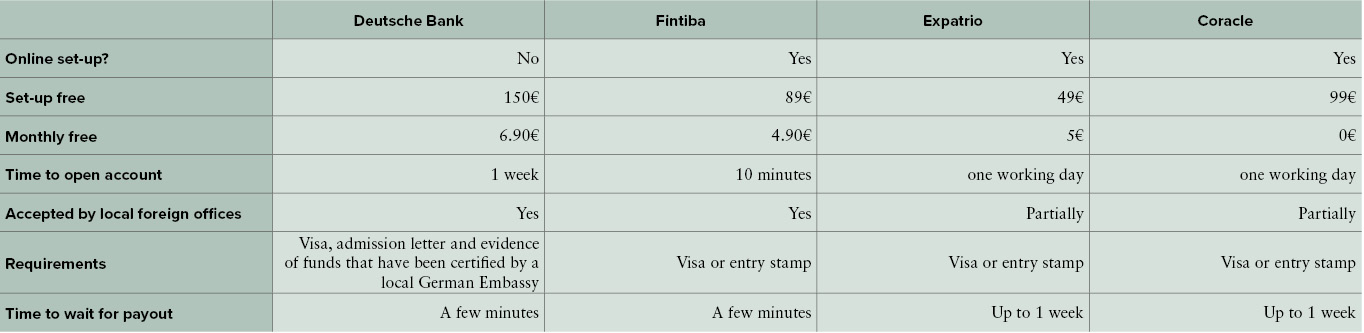

There are 4 main companies that you can choose to use for your blocked account, below you can find a table that compares some of the features of each bank.

We’ve created a table that compares the 4 most popular blocked account providers on things like the set-up fee, time to open an account, and if you’re able to open your account online. This will help you to decide which provider is best for you.

Fintiba is one of the most popular banks to use for a blocked bank account with international students because it’s a very quick and simple process that can be done completely online.

They also only ask you to provide a valid passport in order to be approved for a Fintiba blocked account.

To open a German blocked account as an international student with Fintiba, you’ll need to:

Register on the Fintiba website

Fill out the application form

Transfer the money required for your blocked account, and the additional processing fee

Receive confirmation of your opened blocked account to use in your visa application

Although Deutsche Bank is one of the biggest, and most well-known, banks in Germany, it isn’t the most popular for opening up a blocked account for international students.

The process of getting a Deutsche Bank student account is a bit longer and more complicated as you have to apply through the German embassy in your home country and there’s no online application system.

To open a German blocked account as an international student with Deutsche Bank, you’ll need to:

Download the application form from Deutsche Bank’s website and complete it on your computer

Print two copies - one for yourself and one to take to your German embassy

Make an appointment with the German embassy in your home country. You must bring the following documents with you and have them certified by your embassy:

Completed Deutsche Bank application form

Valid passport

Admissions letter from the university you’ll be studying at

A prepaid envelope

Evidence of funds (e.g. bank statements)

Ask your German embassy to send your completed, certified, and signed application form to the following address along with copies of the other documents you provided:

Deutsche Bank AG

Alter Wall 53

20457 Hamburg

Germany

Once your blocked account has been opened, transfer the minimum deposit and set up fees

Sparkasse is a common regional bank in Germany that offers blocked bank accounts to international students. They don’t have a lot of details about how to apply for an account for their website, so we’d recommend booking an appointment at the Sparkasse branch closest to you, or filling in their contact form for your local branch.

Please note that Sparkasse is a name used by many of the regional banks in Germany and the application process might vary depending on the branch.

If you’d like more information about opening a Sparkasse blocked account, you can find it on their website. You should also search by city or postcode to find the closest Sparkasse branch to where you’ll be staying in Germany.

Check out our undergraduate degrees

Check out our graduate degrees

Expatrio is a website that helps international students move to Germany by offering Blocked Accounts and Health Insurance.

To open a German blocked account as an international student with Expatrio, you’ll need to:

Fill in the online application form on Expatrio’s website where they’ll ask for your visa information

Once the account has been opened, transfer the minimum funds required (Total Blocked Amount)

As soon as the funds have been transferred (which can take 3-5 business days), you’ll be automatically sent your blocked account confirmation - which you can use in your visa application

The final blocked account provider we’ll be discussing is Coracle. This is a popular provider amongst students as it’s one of the few that doesn’t charge you a monthly fee to have the account.

To open a German blocked account as an international student with Coracle, you’ll need to:

Use Coracle’s online form to apply for a blocked account where they’ll ask for your details and an image of your passport

Once the account is opened, you can transfer the minimum funds required

Receive your blocked account confirmation to take to your German embassy

The current amount of money that is required to be deposited into a blocking account as part of an international student visa application is €10,332 or €861 per month.

This is correct as of 11.07.2021, but we’d recommend double-checking before transferring your money - just in case!

The exact amount of funds that you have to transfer to your new blocked account will depend on your stay. You have to transfer this minimum amount to the account in order to use it in your visa application.

After you’ve made this initial deposit, if you want to deposit more money into this account you can.

The cost of your blocked account will vary depending on the banking provider that you use.

The two costs that you can expect to pay for your account is the set-up fee which is paid when you sign up for an account, it can range from €49 with Expatrio to €150 with Deutsche Bank.

You may also have to pay a monthly fee with some providers, but this won’t cost more than €6,90 a month.

To see the costs associated with the most popular blocked account providers, you can see our table above.

It’s always best to open your blocked account as early as you can, just in case there are any processing delays. Without confirmation of a blocked account, you won’t be able to complete your visa application.

As soon as you get your admissions letter from the university you’ll be studying at, you should start your blocked account application.

Remember that you don’t want to leave it to the last minute as there may be lots of other international students also trying to apply for an account, which can mean very long processing times.

Check out our undergraduate degrees

Check out our graduate degrees

This will depend on the provider you use to set up your blocked account. Some providers require you to visit your local German Embassy to get your documents certified which can take time.

Once you have your documents ready and you’ve submitted your application form to your banking provider, it should take up to a week for the account to be open. However, sometimes there may be delays that make this process longer.

You can transfer funds to your new blocked account in Germany the same way you transfer money to any other bank account. Once you’ve signed up with a banking provider, you’ll receive your IBAN and Bank ID code via email or post which you’ll need to make deposits.

You should transfer the complete sum required into your blocked account in one transfer (unless you have transfer limits in your country).

If you want to make deposits in your home currency, double-check that your banking provider allows this, and be aware of the current exchange rates.

Most of the blocked account providers do not ask you to provide the source of money when transferring your initial deposit.

The only bank that does ask for this information is Deutsche Bank. To prove the source of money with them you just need to send a bank statement that shows your bank deposit history.

Yes, a third party is allowed to send the deposit on your behalf. They’ll just need to prove their identity by providing a valid passport.

Most of the blocked account providers do not let you transfer money out of the account whenever you want, after activating the account when you arrive in Germany you can set up a monthly standing order with your bank to get access to your funds.

If you need more money than the available amount in your blocked account, you’ll need to go to a local immigration office and ask for an account release approval. They’ll give you a document that you can submit to your banking provider to release the extra funds.

Once you arrive in Germany, you can activate your blocked account to set up your monthly payments. The way you do this will vary depending on the banking provider you use.

Here’s how to unblock a blocked account for the most popular providers:

Expatrio - Login to their Expatrio User Portal and follow instructions to activate

Deutsche Bank - Complete and send off an online activation form

Fintiba - Log into the Fintiba User Portal and follow instructions to activate

Coracle - Login and upload necessary documents to their Coracle User Portal

If your student visa application has been rejected and you no longer need your blocked account, you’ll need to submit a document from the German immigration office containing the original notice of your visa rejection stamped by the German Embassy.

Depending on your blocked account provider, you’ll either have to send these documents by post or by email.

Yes, your money will be safe in your blocked bank account in Germany.

All German banks are part of a Deposit Protection Scheme that will guarantee your deposits up to €100,000.

Yes, you must show 2 years of expenses in a blocked account.

If you are undertaking a study of more than 2 years, but only put the minimum deposit in your blocked account, they may ask you for more money as you haven’t sufficiently shown that you can support yourself financially for the 2 years you’ll be in Germany.

Your blocked account lasts for a year, what happens after that year depends on your banking provider.

Some providers will let you extend your blocked account if you’ve extended your visa. Other accounts will automatically switch to a normal current account.

Remember that if your account does change to a current account, it may not be free to have anymore if you’re no longer a student.

Yes, most of the block account providers will ask that you have a second current account that isn’t blocked where you can transfer your monthly 861 Euros standing order.

Opening up a blocked account in Germany is an essential task that you should think about early on in your Germany student visa application process. Without this account, you won’t be able to submit your visa (unless you have another way of proving your finances).

We hope that this guide was useful and prepared you for everything you need to know about German blocked accounts for international students.

If you do require more help or have more questions about requirements to study in Germany, you can schedule an appointment with one of our student advisors, or get in touch with our international office. We’ll be able to give you more information and help you through the process of making your account application. Alternatively, you can also attend one of our virtual info sessions.

Learn more about how to study in Germany and the requirements

Learn more about health insurance for international students